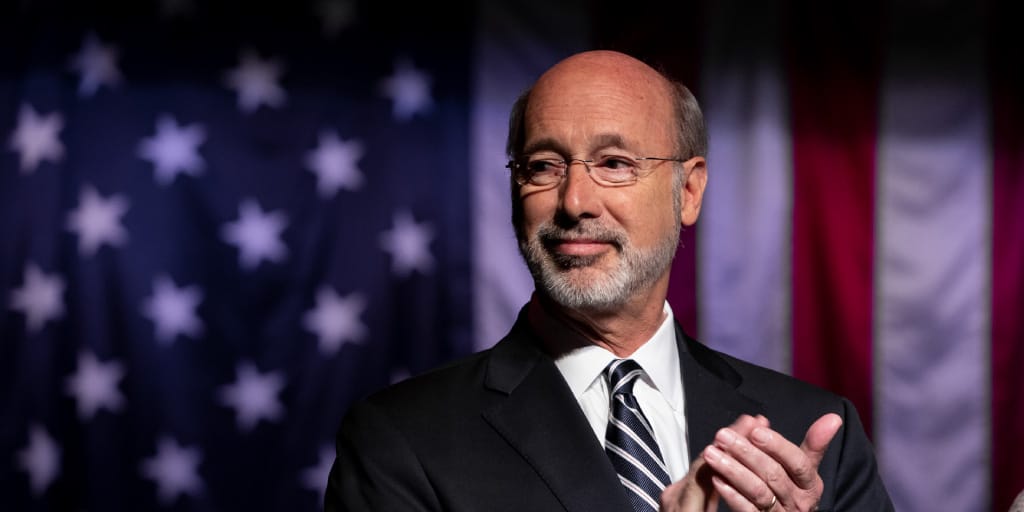

HARRISBURG – As part of the effort to help businesses affected by the COVID-19 pandemic, Gov. Tom Wolf on Tuesday announced businesses that collect Pennsylvania sales tax will not have to make Accelerated Sales Tax (AST) prepayments over the next three months.

That means businesses that normally have a monthly prepayment requirement will not be charged penalties for missing the prepayment deadline during this three-month period.

“The spread of COVID-19 has put a tremendous strain on many businesses throughout the commonwealth that collect Pennsylvania sales tax,” Wolf said.

“Waiving this prepayment requirement will provide support to our businesses at a time when they are doing their part to help us prevent the spread of the virus.”

Under normal circumstances, certain business taxpayers are required to make monthly sales tax prepayments to the commonwealth if their actual tax liability is more than $25,000 during the third quarter of the preceding year.

The Department of Revenue is waiving the prepayment requirement in April, May and June of 2020 to help business owners with cash flow during the COVID-19 pandemic.

“We will continue to work with Governor Wolf and members of his administration to consider other steps that we can take to help the business community,” Revenue Secretary Dan Hassell said.

“It’s important that we do everything that we can to help businesses during this unprecedented health crisis.”

Under this new scenario, the department is asking businesses to simply remit the sales tax that they collected during the prior month.

The due dates to remit sales tax will be April 20, May 20 and June 22, which follows the standard due dates for monthly filers who have no prepayment requirement.

Visit the Department of Revenue’s page on Accelerated Sales Tax Prepayments for more information on prepayments.

All businesses are encouraged to remit online using e-TIDES, the department’s online tax system for businesses. Find the REV-819 on the department’s website for a schedule of return and prepayment due dates.

Taxpayer Service and Assistance

In addition to the waiver of Accelerated Sales Tax prepayments, the Department of Revenue also has:

- extended the deadline to file state personal income tax returns by 90 days. The new deadline of July 15, 2020 is the same as the new federal deadline.

- extended the deadline to file informational returns related to PA S corporations, partnerships, and estates and trusts to July 15, 2020.

- extended the due date for corporations with tax returns due in May to Aug. 14, 2020.

With the department’s call centers closed to help prevent the spread of COVID-19, taxpayers seeking assistance are encouraged to use the department’s Online Customer Service Center, available at revenue-pa.custhelp.com.

You can use this resource to electronically submit a question to a department representative. The department representative will be able to respond through a secure, electronic process that is similar to receiving an email. Additionally, the Online Customer Service Center includes thousands of answers to common tax-related questions.

Find Alerts From Revenue Online

Taxpayers and tax professionals are encouraged to visit the Department of Revenue’s COVID-19 information page on www.revenue.pa.gov for additional guidance and updates on department operations. You can also visit the department’s pages on Facebook, Twitter and LinkedIn for real time updates.

Visit the commonwealth’s Responding to COVID-19 guide for the latest guidance and resources for Pennsylvanians or the Pennsylvania Department of Health’s dedicated coronavirus webpage for the most up-to-date information regarding COVID-19.