Start the clock: the U.S. and China have given themselves 100 days to make progress on the thorny issue of trade.

President Trump toned down his rhetoric when he met his Chinese counterpart, Xi Jinping, late last week. This was not the start of a trade war some had feared.

There was no repeat of claims that China was stealing U.S. jobs by manipulating its currency. There was also no grand bargain between the leaders of the world’s two biggest economies.

Instead, they agreed to a “100-day plan” for talks, according to U.S. Commerce Secretary Wilbur Ross.

What they hope to achieve is unclear. Ross admitted that it was “a very, very short time” for trade talks.

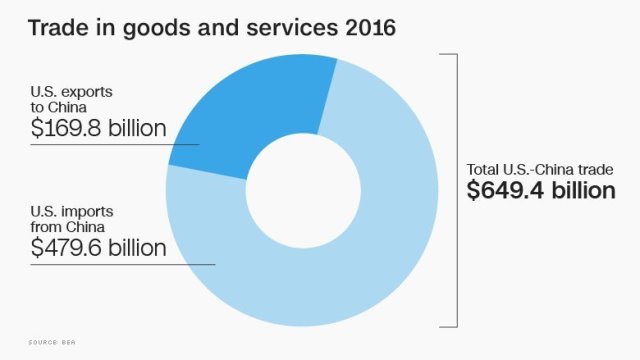

Analysts say China could make small concessions, but they won’t have much impact on America’s $310 billion trade deficit.

“The 100-day timeframe will probably … lead China to give the U.S. administration some quick, easy wins such as deals or announcements on airplane and agricultural commodity purchases,” said Louis Kuijs, head Asia economist at Oxford Economics.

Quick wins

Those wins may include offering U.S. banks and insurers more freedom to invest in China, and lifting a ban on imports of U.S. beef, the Financial Times reported, citing U.S. and Chinese officials.

China’s Ministry of Foreign Affairs said it couldn’t confirm the report.

Moves like that would give Trump small victories he can tout on Twitter. But they won’t make much progress towards the main goal, which Ross described as increasing exports to China and reducing the trade deficit.

Experts say the Trump administration should focus on getting China to do more to open up its markets to American firms rather than fixating on the trade deficit.

“The problem is that significant measures to specifically bring down the U.S.-China trade deficit … would be economically damaging to all parties involved,” Kujis said. “I hope the approach will eventually shift.”

The risk is that heavy handed moves could disrupt the patterns of trade in which countries — including the U.S. — benefit from specializing in particular fields, Kujis said, noting that even China runs deficits with some countries.

Risk of trade war recedes

The main success of the Florida meeting appears to have been the lack of public disputes, despite Trump warning ahead of time that trade issues would make the encounter “very difficult.”

“We have very similar economic interests, and I think there are areas that they clearly want to work with us,” U.S. Treasury Secretary Steven Mnuchin said after the summit.

Such language is a long way from Trump’s campaign threats to slap tariffs of as much as 45% on Chinese goods and label the country a currency manipulator. He hasn’t followed through on either — and the 100-day plan suggests he won’t do so anytime soon.

The Treasury Department’s latest report on currencies “is going to come out in the near future,” Mnuchin said.

Analysts say they think the chances of the report labeling China a currency manipulator are low.

“The threat of a trade war has diminished considerably, at least for the next few months,” economists at Daiwa Capital Markets said in a research note.

— Steven Jiang contributed to this report.