DUBOIS – Four House Republicans from the state General Assembly gathered Thursday to firmly stand up against Gov. Tom Wolf’s proposed 11 percent tax increase, retroactive to Jan. 1, on citizens’ personal income tax, reminding Pennsylvanians that this would hurt not only individuals, but also small businesses.

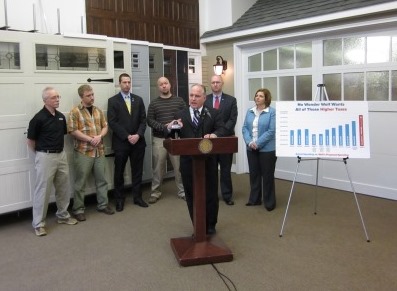

State Reps. Matt Gabler, R-75 of Clearfield/Elk; Martin Causer, R-67 of Cameron/McKean/Potter; Donna Oberlander, R-63 of Clarion/Armstrong/Forest; and Kerry Benninghoff, R-171 of Centre/Mifflin, gathered at Penn Central Door in DuBois for a press conference and called on Wolf to release education funds along with other funding the governor vetoed in the budget passed Dec. 23.

Gabler stated when the $30.2 billion budget was passed, without a tax increase, it included increased funding for education, which Wolf repeatedly stated he wanted. However, the 13 percent in line-item vetoes Wolf imposed included cuts to education, 4H and other programs. “The money is available,” Gabler stated, adding that some school districts are in danger of closing due to Wolf “holding hostage” portions of the budget to get his tax increase.

The governor is seeking $7.4 billion in supplements for the current fiscal year, a spending increase of 5.8 percent for 2015-16 and a 7.9 percent increase for 2016-17.

“The idea of an 11 percent personal income tax hike hits not only Pennsylvanians’ paychecks, but also their savings accounts,” Gabler noted in a press release provided prior to the press conference. “It’s just plain wrong,” he added later during the press conference.

Penn Central Door is owned by the Klark family of DuBois. Founded in 1989 by father Ted, the business was sold to his sons, Andy and Teddy, at the beginning of this year when Ted retired.

Andy Klark, president, spoke during the press conference and noted that while owning a small business is a struggle, it is also rewarding and the company is able to support seven families.

He pointed out that if a business were to do what the governor is proposing, “reach back to pay forward,” they would be out of business.

“It is already a challenge to do business, and it just seems like the governor wants to make it harder,” he said.

Benninghoff noted small businesses also pay personal income tax and the more money taken from them means the less they can pay their workers. And the less workers make, the less they can spend on other things, hurting the economy. “You can’t tax your way into prosperity,” he said.

Benninghoff then pointed to the recently unveiled PennSAVE initiative, which will allow the public to submit suggestions for cost-saving steps the government can implement. He said it makes more sense to find ways to cut costs and be more efficient before going to the taxpayers.

“We can’t afford Gov. Tom Wolf,” Causer stated, “He has an insatiable appetite for spending.” He said the governor is out of touch with how real Pennsylvanians live.

“The General Assembly passed three different budgets which would have brought record funding to public education,” Oberlander stated in the pre-conference press release.

“It is frustrating that the governor completely vetoed the first two and partially vetoed the third, leaving schools across the commonwealth without needed funds and some on the brink of closure. It is time for the governor to stop using our school children as negotiating leverage.”

Gabler concluded that the money Wolf is holding back is leverage for a tax increase that citizens have paid for services they are not getting. “It is so important we get that funding released,” he said, repeating that the services can be provided without raising taxes.

The governor requested budgets he could work with, Gabler said, but with the budgets proposed, and the one that was eventually adopted, he was not willing to meet and work with the legislature.

For more information on the PennSAVE initiative, visit www.pagoppolicy.com/pennsave.aspx or the Web site for any of the GOP legislators.