DUBOIS – The City of DuBois debt refinancing on Wednesday passed the DuBois/Sandy Consolidation Joint Board.

The next step in the refinancing process is for the bond sale to be presented for city council’s consideration. The vote on Wednesday was unanimous, including the five members of the Joint Board who are also voting members of council.

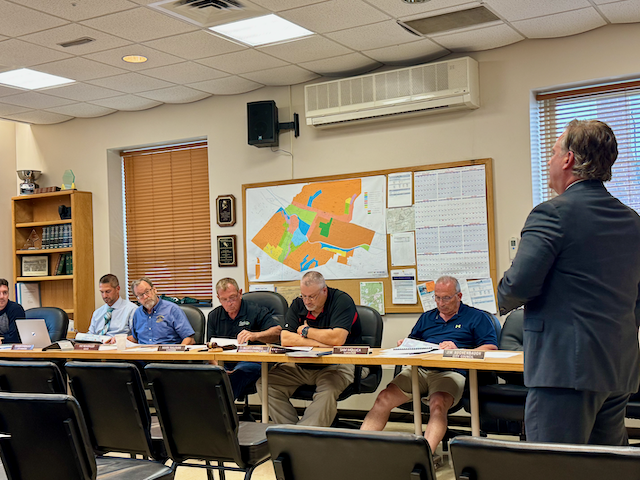

Tim Frenz, managing director of public finance for Janney Montgomery Scott LLC, provided an overview of the refinancing plan prior to the board’s vote.

The bond sale was approved as a “split” sale between a “Series A” and a “Series B,” with “Series A” being refinanced debt and “Series B” being new debt that the state will reimburse through an RACP grant.

Series A

The “Series A” refinancing would save the City of DuBois, and the consolidated City of DuBois after Jan. 1, 2026, $100,000 annually in interest payments.

The bond, and the loans it would pay off when the process completes, both extend out to 2040. It covers only three of the city’s loans through S&T Bank with high-interest rates nearing 6 percent.

These three loans cost the city around $1.2 million/annually in interest, according to Frenz. By refinancing these three loans, the city will still be paying the debt off until 2040, but will save $100,000/annually in interest payments.

This works out to be a roughly $1.5 million savings over the remaining life of the debt, he said.

The two remaining loans were thought to have better rates, according to Frenz, noting that the sewage plant loan is through PennVEST.

The fifth loan, which is through Next Tier Bank, isn’t due for a rate change until 2026.

The current rate—near 2 percent—is so low that bundling it with this set of loans would increase what the city is currently paying in interest.

Frenz suggested that when the Next Tier loan’s rate updates after consolidation happens, that the consolidated City of DuBois could then consider refinancing both the city’s Next Tier debt and Sandy Township’s comparable Next Tier loan together.

Series B

The “Series B” bonds will cover the work being done to the city municipal building so it can be made usable for the consolidated City of DuBois.

This work is being fully covered, up to $2.5 million, by the Commonwealth of Pennsylvania through an RACP Grant. The reason for these “Series B” bonds is due to the RACP grant being reimbursable.

Reimbursement grants require the recipient to complete the project and satisfy payments for funds to be awarded.

This requires the City of DuBois to come up with $2.5 million for the municipal building renovation for the state to turn over the up to $2.5 million.

These bonds will have a maximum life extending to May 2027, but will be written so the consolidated City of DuBois can pay them off as early as May 2026 if it would receive the RACP grant funds that early.

It was noted that there will be $50,000/annually in interest payments on these bonds.