The Pennsylvania Small Business Development Centers (PASBDCs) know that small businesses are the economic anchors in the community and are responding to help as the impact of COVID-19 hits hard.

The SBDC network has the experience and a track record in providing the needed technical assistance and information needed by businesses negatively impacted by these current external factors.

SBDCs deliver consulting services and educational programs through a network of 16 centers across Pennsylvania hosted at colleges and universities.

The PASBDC has enhanced its Web site to give businesses a go-to place for information to answer their pressing questions.

This webpage will continue to be updated as more information is shared and announcements are made at: https://www.pasbdc.org/services/continuity/disruption-recovery.

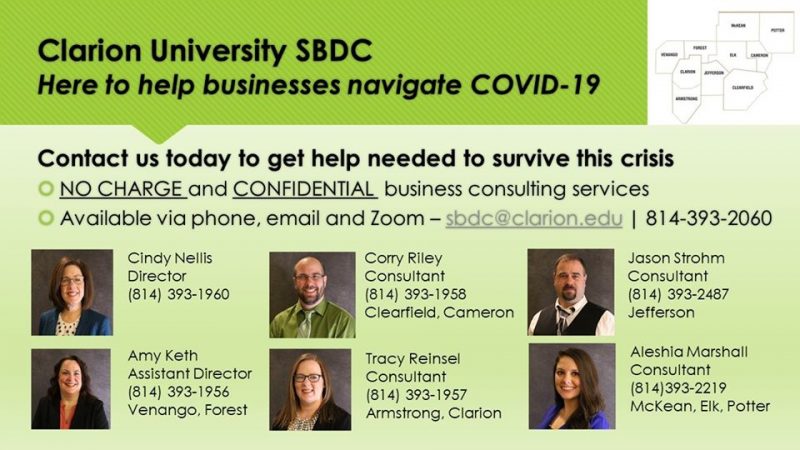

Cindy Nellis, director of the Clarion University SBDC, notes, “It is important that businesses know that technical assistance is close by.

“Our consultants work one on one with businesses to help them make better business decisions and find answers to the critical questions they have.

“Although our center has moved to remote operations, consulting services are available by telephone, e-mail and virtual conferences.”

The Clarion University SBDC provides services to businesses in a 10-county region including Armstrong, Cameron, Clarion, Clearfield, Elk, Forest, Jefferson, McKean, Potter and Venango.

The U.S. Small Business Administration is offering designated states and territories low-interest federal disaster loans for working capital to small businesses suffering substantial economic injury as a result of the coronavirus (COVID-19).

Upon a request received from a state’s or territory’s governor, SBA will issue under its own authority, as provided by the Coronavirus Preparedness and Response Supplemental Appropriations Act that was recently signed by the President, an Economic Injury Disaster Loan declaration.

SBA’s Economic Injury Disaster Loans offer up to $2 million in assistance and can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing.

These loans may be used to pay fixed debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact.

The interest rate is 3.75 percent for small businesses without credit available elsewhere; businesses with credit available elsewhere are not eligible. The interest rate for non-profits is 2.75 percent.

SBA offers loans with long-term repayments in order to keep payments affordable, up to a maximum of 30 years. Terms are determined on a case-by-case basis, based upon each borrower’s ability to repay.

On March 27, the Coronavirus Aid Relief and Economic Security (CARES) Act was passed, which established a new $349 billion Paycheck Protection Program.

This program will provide much-needed relief to millions of small businesses so they can sustain their businesses and keep their workers employed.

This program positions lending institutions as the single point of contact for small businesses – the application, loan processing and disbursement of funds will all be administered at the community level.

This new loan program will help small businesses with their payroll and other business operating expenses. It will provide critical capital to businesses without collateral requirements, personal guarantees or SBA fees and loan payments will be deferred for six months.

Most importantly, the SBA will forgive the portion of the loan proceeds that are used to cover the first eight weeks of payroll costs, rent, utilities and mortgage interest.

The Paycheck Protection Program is specifically designed to help small business keep their workforce employed. Visit www.SBA.gov/Coronavirus for more information.

Contact your local SBDC today to obtain information on financial loans and resources and receive the technical assistance to help apply for the funding needed to survive this crisis. Businesses may request assistance online at www.clarion.edu/sbdc and clicking “Get Help.”

In addition, businesses may contact the SBDC via e-mail at sbdc@clarion.edu or by leaving a message at 814-393-2060. A consultant will return the call.

As a resource partner of the U.S. Small Business Administration, SBDCs across Pennsylvania will be working to help small business owners with questions, technical assistance and understanding the application process for the Economic injury Disaster Loans.

SBDC consulting is confidential and provided at no charge by a staff of skilled professionals. Areas of consulting include but are not limited to: management and marketing assistance, business planning, loan packaging, environmental management and energy efficiency, and long and short-term growth strategies.

Funding for the Small Business Development Center (SBDC) is provided by the Small Business Administration (SBA) and the PA Department of Community and Economic Development (DCED) and host institutions.